|

Have you ever seen the movie “The Secret of Nimh?” It is an old, animated movie from 1982. One of my favorite characters in that film was a clutzy crow by the name of Jeremy. He was voiced by the comedic legend, Dom DeLuise. (I hope some of you remember him.) Jeremy’s claim to fame was being a bit ditzy and his love of “Sparklys.” Anything that sparkled, he had to have. He was addicted.

Most of us would agree with him…to a point. Some of the possibilities:

You might receive a lovely “Sparkly” for Christmas or Valentine’s Day. Or even a birthday? The last thing you want to do is lose a beautiful piece of jewelry. Let’s face it, they are not cheap. Sparkly presents can have a high price tag. Homeowners and Renter’s policies will cover jewelry, but there are limits. There can be two different limits on jewelry coverage. One is the limit for all the jewelry owned in your household. The other possibility is a limit for one item that costs over a certain amount. A modest example:

If your jewelry protection is only $10,000.00, some of your pretties would not get replaced. Or if your policy has an item limit of $5,000.00, you wouldn’t be able to replace Grandma’s wedding ring that is now worth $8,000.00. (These limits were based on one company. Do not assume that if you are below this that your jewelry is protected. Check your policy!) How do you find out what these limits are on your policy? Check your policy or ask your agent. Most of the time you can add coverage to cover important jewelry for a nominal fee. Are there other items that may not be fully covered under your Homeowners or Renter’s policies? Yes. Some of the other items that may not be fully covered:

What to do:

On some things you will need a written appraisal to cover them thoroughly. Above all…. take pictures of your important items! You have no chance of replacing it if you can’t prove you owned it in the first place. Disclaimer: All coverages are subject to the terms, conditions and limitations of the actual policy. Posted by Lara Wilson, Mount Spokane Insurance -- MountSpokaneIns.com

3 Comments

Everyone agrees that this last year has been one of the weirdest on record. And people have responded to that weirdness in bizarre ways. I have concluded that the best thing we can do… the most important thing… the best thing for everyone… is to be kind. How do we be kind? Do we have to swallow every nasty thing others say or do to us? Let people run over us? No. Just…smile. Make it a challenge. How many people can you smile at in one day? What about the masks? They can’t see my face to know I am smiling. They definitely can’t see me smile if I’m on the phone! Smile anyway. They can hear your smile. Does that sound strange? It is true. Many sales courses tell you to smile on the phone. People can hear the difference when you smile. It also raises your spirits when you smile. Perhaps you remember the old adage: “If you are feeling down, force yourself to smile. It will make you feel better.” Look for other ways to lend a helping hand.

Anything to lighten someone else’s load. One of the biggest problems with a pandemic is the separation between us. So many of us see very few people today compared with a year ago. I can go for weeks without seeing anyone but my family. Even my trips to the grocery store have reduced to every other week. I used to go every week. Why did it change? Mostly because remembering masks and hand sanitizer feel like such a hassle. I cannot even imagine how lonely it could get if you live alone without family nearby. And so many of us do live alone now. And if you are retired or work from home? You could easily go for days or weeks at a time without seeing anyone. As you go through your day today, I would ask that you think about that. Think about the person you are talking to on the phone. What if you are the only one, they speak to today? Would you take a little extra time? Be a little more patient? Go a little further out of your way to make them feel good? You may be the only one that has that chance. And, by the way, Thank you for taking the time to read this. I really appreciate you! Posted by Lara Wilson, Mount Spokane Insurance - MountSpokaneIns.com  I have a confession to make... I complained mightily when my Homeowners Insurance rates went up last month. Ilea listened to my complaints and promised to “re-shop” my Homeowners Insurance. (Re-shopping basically means she looks at all the different insurance companies to see if someone else has a lower premium for me.) The bad news…. anywhere else I could get insurance was even higher priced. The good news… it’s a really good price compared to the others. The question is – why is my price going up? There are several factors for that:

So why are there a limited number of insurance companies willing to cover my house?

My insurance price is higher because more damage is likely to happen to my house in a fire than if it were sitting in the middle of Spokane. Our fire rating is significantly lower than Spokane’s. Since I am unwilling to move, I must deal with it.

Apparently they can cause claims by hurting someone outside of my family or by damaging other people’s property. I know it seems logical, but there are people out there that don’t realize that a 300lb horse stepping on your foot can do some real damage. And since she can’t see your foot, you’d better watch out for hers. (And that’s a miniature weight. Regular sized horses weigh 1500lbs and up!) As for the property damage…. (Sparkler, quit leaning on the fence! You’re going to break it again!)…. well, they may have a point.

Some companies don’t want certain types of dogs. Typical restrictions are for wolf hybrids, Pitbulls, Rottweilers, Doberman etc. I have Chihuahuas so, no problem there. Yes, Chihuahuas can be aggressive, but generally can’t do much damage. Some companies don’t want more than 2 or 3 dogs in a household. Seems silly to me but that’s what they say. I have 4. And some companies won’t make exceptions. I was lucky: the company I’m with made an exception to their 3-dog rule because they are so small. It is important that the insurance company makes sure it has enough money in its coffers to cover a major event. Such as a wildfire, like the many we’ve seen lately that take out whole neighborhoods. They need to be able to cover rebuilding all those houses. Each insurance company must get permission from the State Insurance Commissioner to raise rates…. or to lower them. In fact, the Insurance Commissioner has been known to require an insurance company to raise its prices because they did not have enough money saved to cover the losses that may happen. All of these factors are included when insurance companies figure out prices for a particular area. So I complain, even though I know they have reasons. I will continue to complain when my prices go up and ask my insurance agent to look for a better price. And I will remember that there are good reasons for the prices and not yell at her when she tells me: “No, we don’t have a better price.” Posted by Lara Wilson, Mount Spokane Insurance - MountSpokaneIns.com Emergency Pontoons for Your House! Your house doesn’t naturally float in water? No problem! Just hook on our handy emergency pontoons and up your house goes, basement and all. No need to worry about floods. Just $1995.95 plus tax & shipping!

Wouldn’t that be great? Never having to worry about your home being destroyed by a flood? Our neighbors down south could use some of these right now. Hey, I’d buy them and I’m not in a flood zone. We had some flooding problems here in Northeastern Washington and North Idaho this spring. It can be really scary for those in the path of the waters. So what do we do until some genius comes up with pontoons for a house? First, check your insurance policies. Your homeowners insurance is not going to cover floods. This may be a bit of a shock for some people. But the truth is…homeowners insurance hasn’t covered flood problems in a very long time. You need Flood Insurance. That’s right, if you don’t have a policy that says Flood insurance on it…well, you don’t have coverage. Homeowners insurance covers a limited range of water issues. A pipe suddenly breaking inside your home would be covered under most circumstances. Or if a tree falls, breaking a hole in your roof while it’s raining….likely that will be covered. Most water coming in from outside—is not covered. There are some exceptions to that rule. Some policies have a coverage for sewer backup that you can add on. But a hose that gets left on and pours into your basement? Sorry…no coverage for that. The nice thing is that there are more options for Flood insurance now. Better coverages and prices and more companies offering it. So, who needs to make sure they are covered for floods? According to the Federal Government – all of us. They have some good reasons for that very blanket statement.

You could get flooded. Many people were very upset after Hurricane Katrina because, while the wind didn’t damage their home, the flooding did – and it was not covered by homeowners insurance. Anyone in the path of potential hurricanes should have Flood insurance! It may feel like a waste of money but if you don’t have it when you need it….that’s far worse. Likewise, anyone who lives near a river that only floods every 100 years or so….get Flood insurance! Pay attention to what your mortgage company requires. They have good reason for requiring extra coverages. The consequences are not just replacing your belongings but…

Until someone creates those emergency pontoons for houses…Flood insurance is our best bet. Please someone, come up with a way of attaching pontoons to houses fast. Please? Disclaimer: This is very general information. To discover what you are covered for, read your policy and speak with your agent. Disclaimer 2: Earthquakes and landslides are other types of disasters not covered by homeowners insurance. In some areas volcanic eruption/lava flow and hurricanes are not covered by homeowners insurance. These disasters can be covered by additional but separate polices. Ask your insurance agent. Posted By: Lara Wilson, Mount Spokane Insurance - MountSpokaneIns.com There’s nothing worse than losing your home and all your belongings…..

Unless it’s finding out your insurance won’t replace it all. Most home insurance includes a percentage for contents coverage. That would be your stuff:

So, if your house is insured for $300,000.00, you have up to $300,000.00 to rebuild it. To replace your things, generally the policy would include 70% for contents. That means you would get $210,000.00 worth of your stuff replaced. There’s a potential problem, according to Pat Cummings of Capstone Construction, Inc. Capstone is a restoration company that frequently works with insurance companies and homeowners to fix damaged homes. Pat poses this question to insurance agents: “Is this policy going to cover what we in the restoration business call ‘a content rich environment’?” Few of us throw things away as quickly as we could. And most of us collect something. Pat: “Collectors gather all kinds of items, some valuable, some not. Hummel’s, dolls, sports cards, silver spoon collections, scale trains and cars, beer signs and every other kind of thing you can think of. I have seen match book collections, typewriter collections, tool collections, antique anything collections, lead army soldiers, plastic flowers and even a computer collection.” I certainly understand this, my grandparents were serious collectors. They had a number of different things they collected. Even though we have gotten rid of a number of their collections, some remain stuck in a corner of the basement. Like my grandmother’s collection of fabric. She was an avid quilter. There are at least 10 large storage boxes of fabric. Would I replace it? No! But that leads to another issue. Pat: “Often times they have large amounts of garbage.” Or things we wouldn’t replace. Pat: “Cleanup of which generally still falls under contents coverage.” I’m definitely seeing a problem. Pat: “Compulsive buying disorders (CBD) are reported to include about 5.8 percent of the general population in the U.S. This seems correct to me, as we have come across it quite a few times over the years. These people often have whole rooms dedicated to the storage of brand new racks of clothing, shoes and other items that still have the tags on them. We just completed a fire job that the customer has a compulsive buying problem. The $500,000.00 content coverage didn’t cover all the cleaning, storage and replacement of the contents because of the volume of high value contents.” I found quite a few clothing items of my grandmother’s with tags still on them. In fact,--wince-- I have a couple in my own closet. You know those things that don’t quite look right on you now, but with a few tummy crunches, would look great? Pat: “One other area that comes into play is the retirement age population. Often these people have had a lifetime of living to gather valuable contents and a large house. At retirement time often people move into a smaller dwelling, but the value of their contents don’t necessarily follow that trend. While coverage concerns of their dwelling may be smaller, the value of their contents may not have been reduced.” I can see people outgrowing their contents coverage even without moving. My grandparents definitely outgrew their contents coverage. Now the big question….How do we make sure that giant TV gets replaced?

Thanks, Pat, for all your help! Posted by: Lara Wilson, Mount Spokane Insurance - MountSpokaneIns.com & Pat Cummings, Capstone Construction, Inc. - Capstone247.com Christmas is a time of giving. Even though we give throughout the year, we emphasize giving at this time of year. Some of us have done our shopping and have all our gifts purchased. And some will be doing that over the next few days.

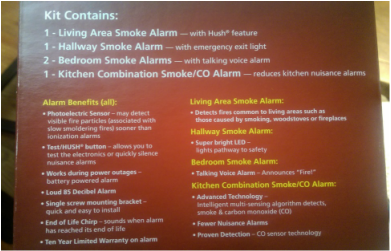

Have you ever thought about what you are giving to the world? Ah, you’re thinking I mean reducing plastic or planting trees. Those are good gifts but not what I meant. Every day you are giving something to the world. Either “candy” or “coal”…figuratively speaking. “Coal” would be most of what you hear on the news. But it can be: · Impatience in the grocery store. · Rudeness in driving. · Or just ignoring an opportunity to be kind. I read a story recently about a family that asked a very interesting question of their kids every day. Before asking “How was your day?” or “Do you have any homework?” They asked…. “Who were you kind to today?” That’s a way of giving “candy” to the world! Being kind to one person has an effect on so many others. Those getting the kindness, those giving the kindness and those witnessing the kindness. And it’s contagious! There are so many ways to be kind, everyone can afford it. · Letting someone go in front of you. · Holding a door. · Being patient. · Or even just smiling. Sometimes when you watch the news it’s hard to remember the good stuff. So I’m challenging you to give as much “candy” as you can this Christmas season! We might even be able to change the world! Posted by: Lara Wilson, Mount Spokane Insurance - MountSpokaneIns.com  At least that’s what it feels like. My brain scrambles trying to figure out what woke me and why my ear and head hurt. I hear nothing but silence… After jumping awake like that, it takes a while to relax enough to sink back into sleep. Just about the time I have completely relaxed, the ear- piercing sound jolts me again! This time I know what it is --- that @^%$*^# smoke alarm! It was the “chirp” of the smoke alarm dying. Why does it always die in the middle of the night?!? So what do I do? Storm across the room, rip the batteries out of it and go back to bed. (Where it takes me a good hour to calm down enough to fall back to sleep.) My problem is trying to remember to put fresh batteries into the @%^$% smoke alarm again. I know how important they are. “Three of every five home fire deaths resulted from fires in homes with no smoke alarms (38%) or no working smoke alarms (21%).” –According to the National Fire Protection Association’s 2015 report. Not too long ago I had a couple of smoke alarms completely die on me. Even when I changed the batteries, they wouldn’t quit chirping. That sent me shopping for new ones and I discovered something wonderful…. You can now buy smoke alarms with sealed 10-year batteries! No more changing batteries on the darn things! Even if they only last 5 years, it will be a relief. And when they die… I can take a hammer to them and vent my frustrations. I was able to buy a box of five to outfit the whole house. It has a hallway smoke detector with an emergency exit light. Two bedroom detectors that say “fire” as well as the piercing sounds. A living room one with a hush feature to allow you to quickly silence nuisance alarms. And a kitchen smoke detector that also reduces nuisance alarms. (The kitchen one also includes a Carbon Monoxide detector.) If you have the same problem I do with being woken up in the middle of the night to a dying battery on your smoke alarm or forgetting to change the battery, look into these 10-year smoke alarms. You should be able to find them at most hardware stores. Smoke alarms are extremely important for our safety. Ask your insurance agent about discounts on your home or renter’s insurance for smoke detectors. Posted by: Lara Wilson, Mount Spokane Insurance - MountSpokaneIns.com Getting Business Insurance can be a fast and easy process or one of the longest, most tedious. Why is this? There are a number of factors. Let me tell you what it looks like from “behind the scenes.”

First you call us and say you want to see if you can get some better rates on your business insurance. We get on the computer and proceed to ask you questions about every aspect of your business. We usually run across a few questions that you don’t know right off hand and we’re stuck. We can start to filling in the two dozen or so forms but we can’t submit anything until they are completely filled out. In personal auto or home insurance, 90% of people will fit into specific categories that a computer can authorize and issue a policy. In business there are too many different possibilities and judgements for a computer. Business insurance is handled by human underwriters. That’s why it’s important that we fill out the forms as completely as possible. Frustrating underwriters by not giving them enough information, is not good for business….yours or ours. After we get all the forms filled out, we begin submitting them to different companies. If you have a simple business that any insurance company would be happy to insure, we could have a quote for you in a day or two. If your business is more complicated, has more parts to it or is considered more risky, it would look a bit more like the following description.

This description is for a “medium” size business. As I said, for a “small,” less risky business it could be as easy as car insurance. “Large,” even more complicated businesses can take 6 months to a year. If you know you have a complicated business with a large inventory or one that tends to be risky (for example- roofing), start checking on new insurance as soon as possible. Something to keep in mind when you look at your business insurance. We are happy to help you out with your business insurance needs. If you would like to know if your business is one that could take some time, give us a call. We should be able to give you an idea of the timeframe. Posted by: Lara Wilson, Mount Spokane Insurance - MountSpokaneIns.com |

Mount Spokane InsuranceWe are an independent insurance agency handling over 80 different insurance companies. All posts will have the author's name at the end. Blog Archives

June 2021

Categories |

Copyright © 2016 - 2018 Mount Spokane Insurance. All rights reserved.

RSS Feed

RSS Feed